Pension and Retiree Health

Overview

Welcome to our “one-stop-shop” for community members interested in information on post-employment benefits. Below are links to hundreds of pages of financial data and information regarding our financial assets and liabilities, pension reform actions, and retiree health reform actions. Please see the box “By the Numbers” for a brief summary of current assets and liabilities.

In short, we offer our employees two post-employment benefits: a pension and a contribution towards retiree health care costs (also referred to as other post-employment benefits, or “OPEB”). Both of these benefits have been significantly reduced since the California Public Employees’ Pension Reform Act (PEPRA), which took effect in January 2013.

We are committed to financial transparency and have provided this information to make available financial details and answer questions.

Actuarial Valuations

Pension

The most recent pension actuarial valuation was prepared as of June 30, 2021. This valuation governs the employer and employee contribution rates for the fiscal year beginning July 1, 2022. This valuation (produced in February 2022) reports our pension funded ratio to be 95.8%. The funding ratio is expected to improve over time, as the unfunded liability is paid down; however varying investment returns will result in fluctuations to the ratio. The City, via MCERA, has a funding strategy in place based on sound actuarial practices that will ensure the long-term viability of the retirement plan.

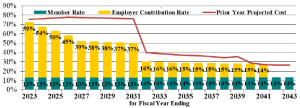

The City of San Rafael’s contribution rate is projected to gradually decline through 2029 as deferred investment gains from the prior years are recognized and PEPRA members become a larger proportion of the active member population. In 2030 a significant reduction is projected to take place as the unfunded liability from the original amortization base established in 2013 is paid down. This unfunded liability represents the excess of the Plan’s actuarial liability over the actuarial value of assets per the June 30, 2009 valuation following the Great Recession. At that time, the MCERA Board took action to indicate that beginning with the June 30, 2013 valuation this liability would be amortized over a 17-year closed period. The unfunded liability currently makes up 39.91% of the total 58.91% employer contribution rate for fiscal year 2021-2022, thus once the unfunded liability is fully amortized the City will experience a substantial reduction in contribution rate, currently projected for 2030.

Projection of Employer Cost as a Percentage of Member Payroll

See this overview as part of the June 30, 2021 valuation

OPEB (Retiree Medical)

The most recent OPEB actuarial valuation was prepared as of June 30, 2019. This report calculates the unfunded liability at $26.5 million at June 30, 2019. A GASB 75 Accounting Information report will be prepared for June 30, 2019 and used in the preparation of the City’s financial statements for fiscal year 2019-2020.

The information provided below is intended to demystify the impact of pension and retiree health benefits in San Rafael.

Just the Basics

We negotiate employee compensation agreements with multiple unions under a number of state and federal laws. We strive to provide a competitive salary/benefit package to attract and retain a highly qualified workforce while maintaining a balanced city budget.

Since PEPRA took effect in 2013 benefits offered to new employees have been greatly reduced. According to a March 24, 2013 analysis of our pension and retiree health reforms to date and found that our actions will result in a savings of $132 million over the next 30 years.

More Information About San Rafael Pensions and Retiree Health Benefits

The City Council has taken a number of decisive steps towards reducing post-employment benefit costs including significantly reducing employee pension and retiree healthcare benefits. Here are some facts in the form of frequently asked questions:

By the Numbers

-

- A full discussion of retiree obligations must include both pension and retiree health and consider assets as well as liabilities. Below are the current approximate numbers for San Rafael as of the most recent actuarial valuations:

- Pension Assets:

San Rafael Pension Assets: $610.2 million

Pension Fund Set-Aside Assets: $2.7 million

Total Pension Assets: $612.9 million - Pension Liabilities:

San Rafael Pension Liabilities: $637.2 million

Pension Bond Debt: $2.8 million

Total Pension Debt: $640 million

95.8% funded ratio - Retiree Health Assets:

San Rafael Retiree Health Total Assets: $23 million - Retiree Health Liabilities:

San Rafael Retiree Health Total Liabilities: $48.9 million

47% funded ratio

- Pension Assets:

- A full discussion of retiree obligations must include both pension and retiree health and consider assets as well as liabilities. Below are the current approximate numbers for San Rafael as of the most recent actuarial valuations:

The above means that, like most plans in California, current obligations exceed current assets, creating an “unfunded liability.” This liability is paid off over time between contributions and investment returns.

Data Sources:

Additional Information

- San Rafael Labor Negotiations

- MCERA Actuarial Valuations: Annual valuation reports as of June 30 for all years 2002-2021

- MCERA Governmental Accounting Standards Board (GASB) Statement 67/68 Reports as of June 30 for all years 2014-2021

- MCERA Audited Financial Statements of June 30 for all years 2008-2021

- Independent Committee on Pension Reform Report (June 2019)

- Citizens' Group on Pension Reform Report (March 2014)

- Marin County Civil Grand Jury Final Reports 2000-2020